15. May 2025 By Dr. Michael Hartmann

From AI hype to a changed business model – Data Driven Insurance (DDI)

The speed at which Artificial Intelligence (AI) is evolving today is immense. In addition, the quality of AI is constantly improving. It is therefore not surprising that AI applications are already being used in early implementations in many insurance companies. The way is paved for the future: insurance companies have a large pool of data at their disposal that is often underutilized, and with the help of AI, they can unlock new potential in their interactions with customers. Business models are changing in the direction of Data Driven Insurance. The following article describes what this could look like.

DDI - Data Driven Insurance

Data Driven Insurance (DDI) is our framework for creating an even better customer experience by focusing on the customer and leveraging AI. Whether through more personalized offers and services or through more efficient and autonomous processes for the customer along the customer journey.

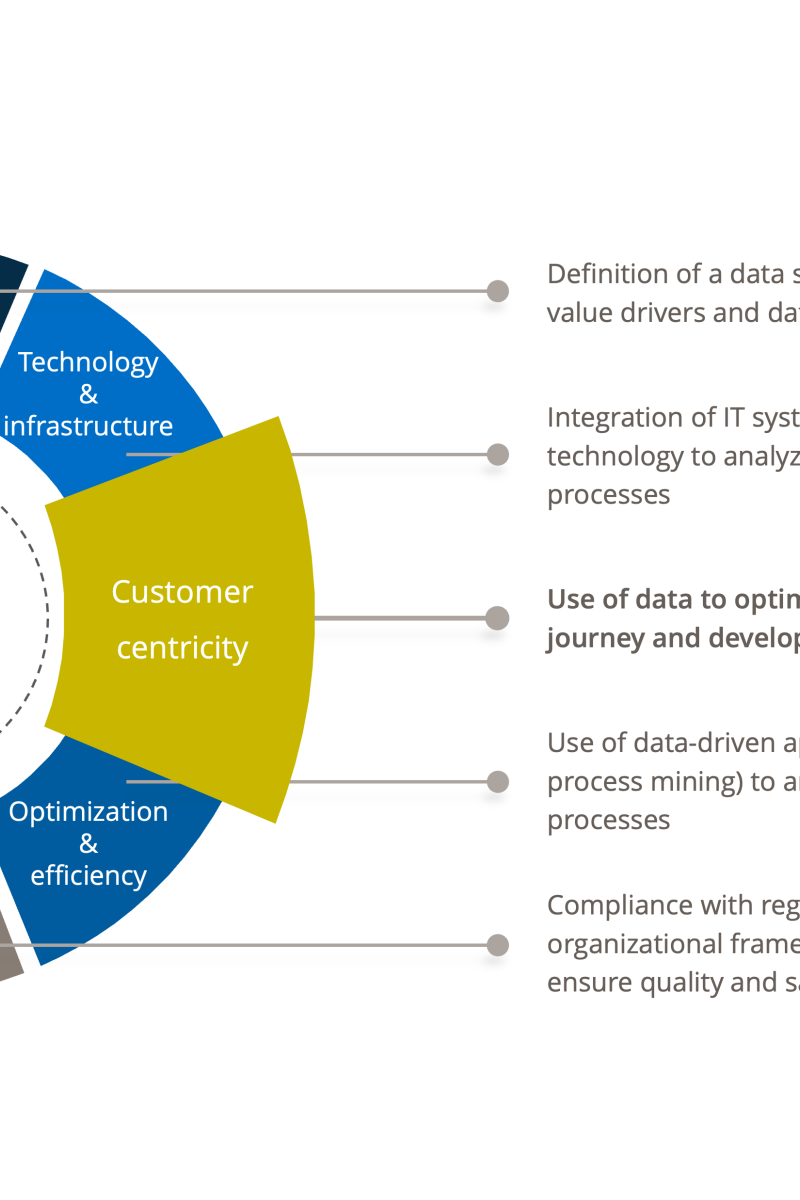

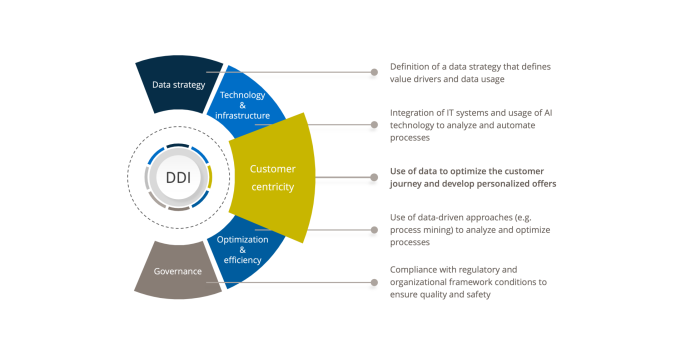

The DDI framework contains several elements that define the framework conditions for data-driven activities. These range from strategic and technical considerations to procedural and regulatory conditions (see figure 1).

Figure 1: DDI framework

The data strategy ultimately forms the basis for further activities. Initially, the data strategy defines fundamental guidelines. For example, it defines whether data should be used more for operations or as a growth driver. Another question that arises is whether data should be used only internally or in an ecosystem where it is also shared with partners. Based on such questions, a data vision is formulated and the implementation to achieve this vision is mapped out in a roadmap.

The technological foundations are defined on the basis of the strategy. On the one hand, a blueprint of the data architecture is required. This defines how data is held and merged. On the other hand, the technical infrastructure to be built on and the technological components to be used must be determined.

The Customer journey is at the core of DDI. Data should ultimately be used to generate added value for the customer. This added value can result from faster handling processes, more diverse options or highly personalized products and services, all of which are usually supported by AI. In the second part of this article, we will look at precisely these points in more detail.

As every process leaves data traces, intelligent procedures can be used to check whether the process itself is running as efficiently as intended or whether there is room for improvement. As part of a continual enhancement process, monitoring and benchmarking are used to continually elevate process efficiency and quality.

In addition to the Data Protection Act, there are now other regulations governing the use of customer data by AI, such as the EU AI Act. These must of course be considered. However, this is only part of the governance aspects that need to be considered. Technological and organizational factors also play a role. As these aspects are very central, we will go into them in more detail in the final section.

Customer centricity

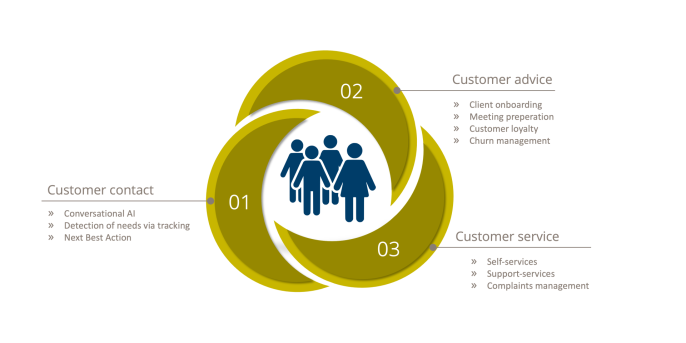

As previously mentioned, Customer centricity is at the core of DDI. We see the following points of interaction: customer contact, customer advice and customer service (see figure 2). For each of these points of interaction, there are a variety of use cases that – supported by data and using AI – enable a better customer experience and thus a better value proposition.

Figure 2: customer focus – use cases supported by DDI

Customer contact: In the past, most insurers have pursued an omni-channel strategy so that customers can be served consistently across all channels. However, channel integration and synchronization is very time-consuming and costly. It is therefore not surprising that many insurers now primarily manage the digital channel and are committed to a "digital first" or "mobile first" strategy. However, for this channel to be used consistently, the customer must be able to be served completely via this channel. Conversational AI is one of the most important topics in this context: customers should not have to call a call center or ask an insurance agent when they have questions but should be able to converse with an AI completely naturally via text or voice input. In contrast to the chatbots that existed just a few years ago, this is now possible without any problems – and in almost any language, including Swiss German. In addition to providing information, AI can also do much more in the customer dialog: by reading out tracking information, it can identify individual customer needs that can be explored in more detail in the dialog, and it can also identify additional protection needs that can be covered by additional coverage modules (Next Best Action).

Customer advice: As just described, the transition from customer contact to customer advice is naturally fluent. Even if the ROPO effect (Research Online, Purchase Offline) has certainly declined compared to the past, personal advice has not yet become obsolete. DDI can be helpful here as well. First, AI can be used by advisors, whether in the service center or in the field, to get a quick, summarized overview of who the customer is and what relationship they have with the insurer. In this respect, the customer experience is already improved because the customer does not have to explain himself first. The AI can also provide the advisor with detailed information on whether a customer is potentially at risk of churning. If so, effective action can be quickly discussed and, in the best case, customer loyalty can be increased.

Customer service: Customer service activities are either seamlessly linked to customer advice or result from the customer contact. Again, conversational AI is used to assist and support customers. AI can also be used in complaint management – especially if it includes sentiment analysis components. The most important issue in customer service, however, is self-service. The more tasks customers can complete independently, the less they need expensive infrastructure, such as a telephone hotline or service center. With the help of Agentic AI, in which various AI systems interact with each other, more complex tasks such as a benefit check and payout, can now be carried out autonomously and efficiently, which significantly improves the customer experience.

Framework conditions

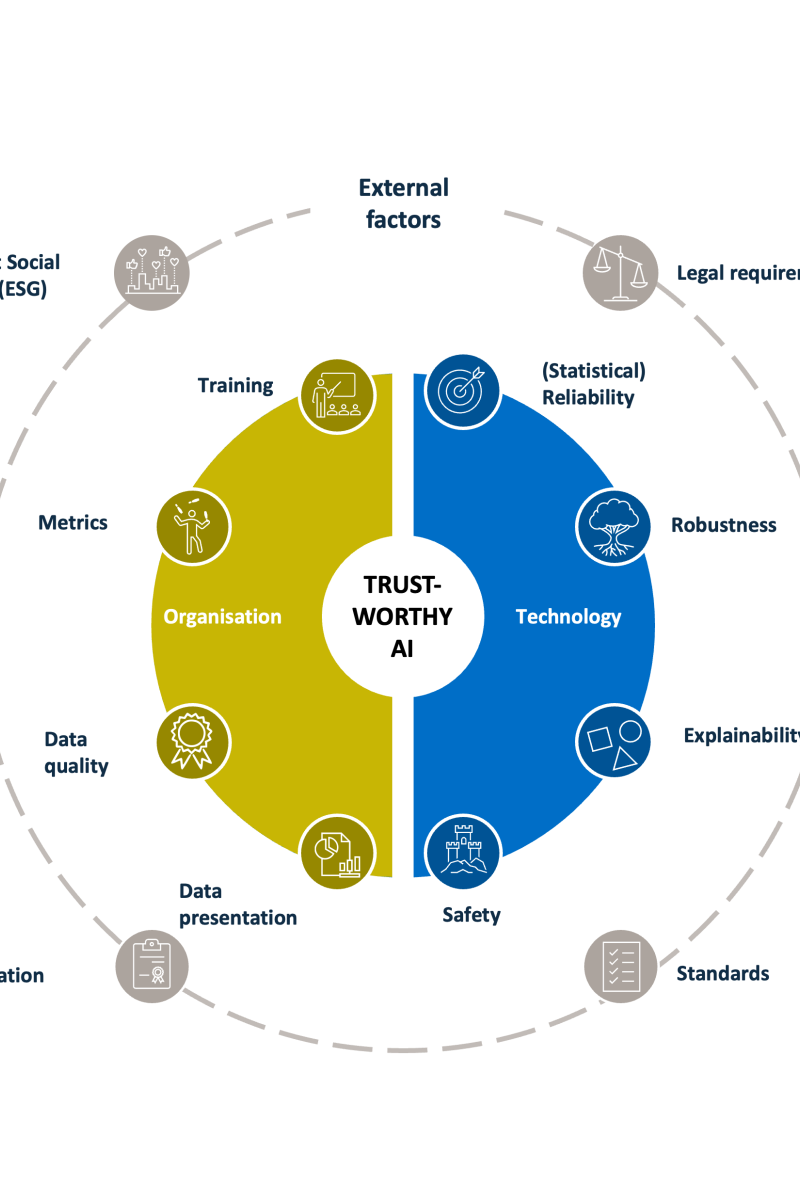

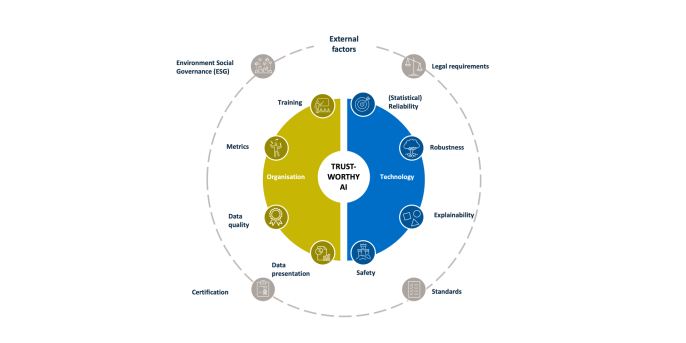

In addition to improving the customer experience, all these data-driven and AI-supported activities must take into account the framework conditions, as AI must always meet trust and security requirements as well as the needs of employees and customers. When using AI, we generally refer to the Trustworthy AI Framework, which acts as a construction kit to define the relevant framework conditions. The framework was developed as part of the “AI for good program” under the umbrella of the ITU (International Telecommunication Union) and is technology-agnostic. The dimensions considered are external factors, organization and technology (see figure 3).

External factors include all types of regulations (e.g. nDSG, EU AI Act), some of which are supplemented by other certifications (e.g. ISO 9001, ISO 27001, ISO 41001) and guidelines (e.g. ethics, fairness). Together with the customer, we decide which security and quality standards should be complied with and applied throughout the company.

However, this view covers only part of the components that are crucial for trust in AI. Technical factors are at least as important, such as the robustness of AI models, their reliability, their security and, above all, their explainability.

Finally, organizational measures are required to complete the view and establish a trustworthy AI. These include training courses and quality assurance measures, as well as processes for data management and data output and presentation.

Figure 3: Trustworthy AI

Conclusion

In summary we see the rapid development of Artificial Intelligence technology combined with the wealth of data available to insurers as the key driver for changing business models in the insurance industry. This combination – which we call Data Driven Insurance – is giving rise to new product and service modules for greater individualization and autonomy on the customer side. Nevertheless, it is important not to ignore the associated framework conditions. Trustworthy AI provides a framework that covers all relevant governance aspects.