4. August 2022 By Dr. Christina Mpakali and Alexander Eppenberger

Blog series Blockchain: How the new technology is finding its way into the Swiss banking world (Part 2)

In the first part of the blog series on blockchain we outlined the historical development of blockchain technology. Now we turn our attention to the Swiss financial centre: How has the fintech scene developed in the area of blockchain since the banking crisis and the birth of Bitcoin?

Development of Swiss crypto fintechs

A historical overview of selected Swiss crypto fintechs (the list is not exhaustive) shows that, analogous to the development of blockchain technology, Switzerland has launched many crypto companies that have become established in the present day.

2013

- Ethereum - already mentioned in the first blog post. Click here to read it.

- BitcoinSuissE offers prime brokerage, custody, secured lending, staking, tokenisation, payments and additional services.

2014

- Bittrex Global is a digital asset trading platform designed for international clients.

- Metaco offers a secure infrastructure for financial institutions which enables financial institutions to enter the digital asset ecosystem.

- The Tezos Foundation, a Swiss foundation supervised by the Swiss Federal Supervisory Authority for Foundations, aims to promote and develop new technologies and applications in the areas of open and decentralised software architectures.

2015

Cardano develops a smart contract platform similar to Ethereum, but with improved scalability for mass use.

2017

Crypto Finance is active in three core businesses: regulated asset management, crypto assets brokerage, infrastructure services for the secure storage of crypto assets, and tokenisation projects.

2018

- FINMA publishes the Fintech licence, which comes into force in 2019. It allows innovative companies in the financial sector to obtain a simplified licence under the Banking Act. In the same year, FINMA becomes the first regulatory authority in the world to publish the ICO Guide (Initial Coin Offering ), regulating the issue of blockchain-based tokens. As ICOs have points of contact with Swiss financial market law, FINMA enables the use of innovative technologies with this interpretation. Accordingly, the first two Swiss crypto banks, Sygnum and SEBA, also emerge.

- Custodigit, geared towards financial institutions (a joint venture of Swisscom and Sygnum, and participation of SIX since 2020), offers secure access to and storage of digital assets. The platform covers the entire lifecycle of digital assets.

- Daura is a digital share platform with a focus on financing and investing in Swiss SMEs. Blockchain technology digitises the existing share register and enables capital increases at the push of a button.

- Blockstate is a Swiss security token platform for non-bankable assets. The company digitises these assets to directly connect issuers (issuer of the asset) and investors.

- Flovtec provides liquidity for tokens and exchanges. Many digital assets are not tradable because liquidity is lacking. This is why liquidity is central: in a liquid market, transactions of digital assets can take place at any time.

2021

- The DLT Act comes into force. In summary, trading, custody, and settlement of digital assets will be regulated from a single source. This applies not only to banks or brokers but also to retail customers. To this end, Switzerland adapted numerous existing laws (Anti-Money Laundering Act, Financial Services Act, etc.) so that the regulated use of blockchain technology is made possible.

If one compares this company emergence with historical blockchain development, in 2018 (the year of the NFT and the DeFi movement in Switzerland) the first crypto bank emerged alongside numerous companies specialising in tokenisation (digitisation) of assets.

This was also the year that FINMA established the first regulatory course so that innovations could be regulated but not promoted with restrictions. With the creation of the DLT Act, Switzerland also laid an important foundation for the industry, which is still viewed with suspicion in many parts of the world. However, it is precisely this legal framework that provides security and thereby creates trust for companies and customers. Due to the pragmatic approach of the regulator, favourable conditions have been created for blockchain companies, this enables a thriving ecosystem.

Many blockchain companies are increasingly attracted to Switzerland. As of January 2022, the Swiss Crypto valley counts over 1,100 blockchain companies with 6,000 employees (by comparison, the traditional financial sector employs 220,000 people). Zug remains the frontrunner, followed by Zurich.

Many blockchain companies are increasingly attracted to Switzerland

| Rank | Location | Number of blockchain companies |

| 1 | Zug | 528 |

| 2 | Zurich | 204 |

| 3 | Liechtenstein | 85 |

| 4 | Geneva | 69 |

| 5 | Ticino | 50 |

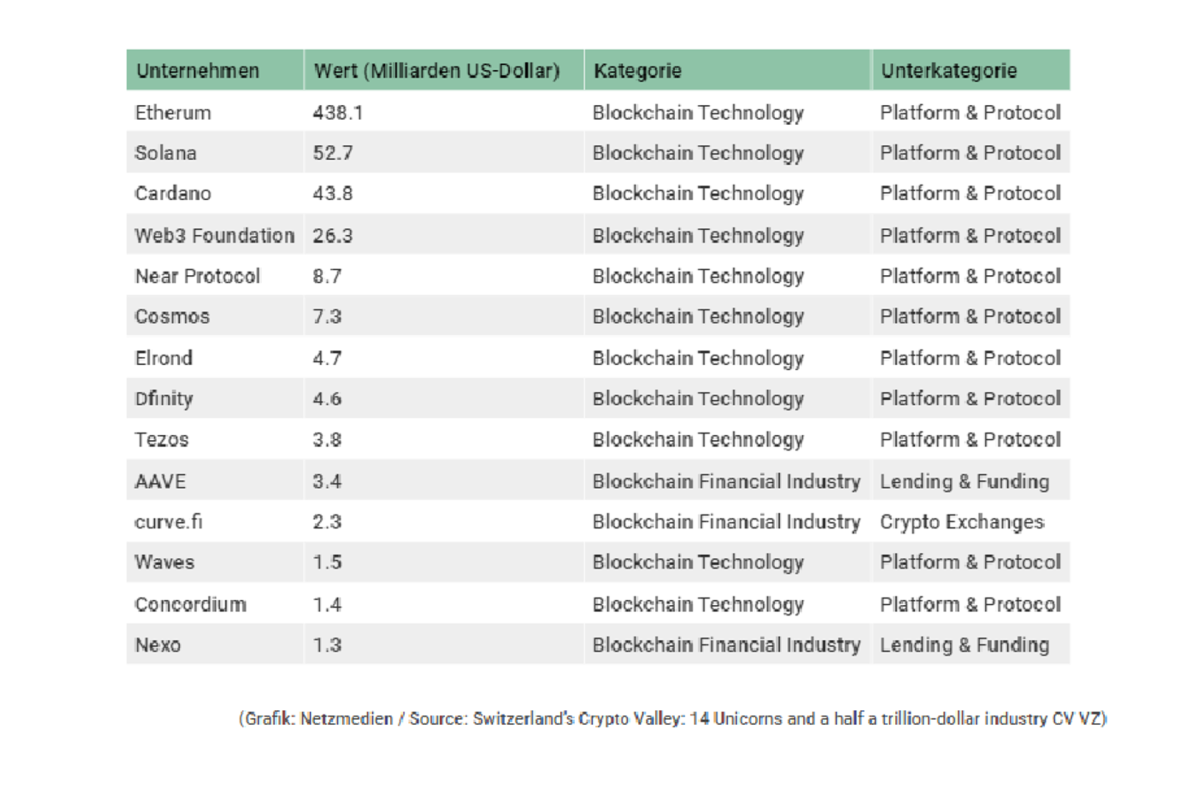

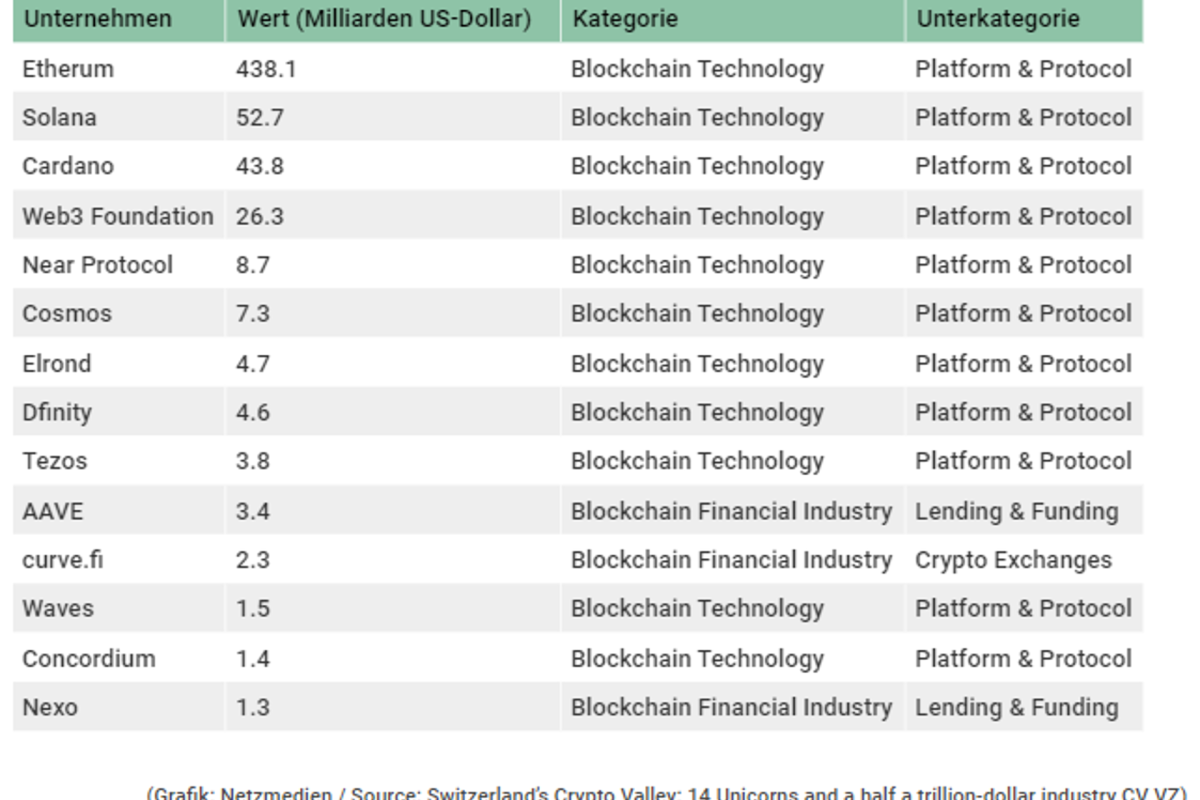

The top 50 startups are said to be worth USD 612 billion (five times the market value of the previous year) and 14 unicorns (companies with a valuation of over USD 1 billion) are located in the Swiss crypto scene (as of 2021). A year earlier, there were eight and in 2019 only four. This shows the rapid development in the industry.

An international comparison shows that there are around 2,400 blockchain start-ups in the USA (source: Crunchbase). In the EU, there are a similar number, around 2,300 (source: Crunchbase). Of these, around 300 are in Germany. Twice as many are located in the UK (Source: Crunchbase). Southeast Asia has over 600 crypto companies . Among them is one of the largest cryptocurrency trading platforms, Binance, whose own currency ranks fifth by market capitalisation (as of Coingecko May 2022). Globally, most blockchain companies are located in Europe (incl. Switzerland) and the USA, because capital procurement there offers a secure framework for action.

If we compare the number of blockchain companies in the USA, the EU and Switzerland in relation to the number of inhabitants (see table), it is remarkable that small Switzerland has up to a factor of 25 or a factor of 17 more blockchain companies than the EU or USA.

The number of blockchain companies in the USA, EU and Switzerland in relation to the number of inhabitants.

| Region | Inhabitants (as of 2021) | Blockchain companies | Blockchain companies per 1 million inhabitants |

| USA | 332 Mio. | 2'400 | 7 |

| EU | 447 Mio. | 2'300 | 5 |

| Schweiz | 8.8 Mio. | 1'100 | 125 |

Thanks to FINMA's innovation-friendly regulation, which is also shown by the current figures, Switzerland is securing long-term economic advantages for the future by attracting foreign blockchain companies. If we look back at Swiss Blockchain companies, it is interesting to see that one in six Blockchain companies earns its money in the financial sector. Throughout this development of blockchain technology and crypto fintechs, forms of cooperation between the crypto world and the Swiss banking world have also emerged.

Outlook

In the final part of the series, we will highlight some examples of crypto from the Swiss banking industry with a view to where the trend could develop in the coming years.

Part 1 of the blog series

"How this new technology is finding its way into the Swiss banking world"

Read now