3. February 2022 By Christian Sauer

Risk – what the world can learn from reinsurance in a global pandemic

‘A physicist, a rocket scientist and a doctor walk into a bar’ – this sounds like the beginning of a vaguely funny joke, but at the same time it is everyday life at every large reinsurance company. Why is interdisciplinarity so important? Reinsurers bear the risk for almost everything, from building large dams to launching rockets in Florida. ‘Risk bearing’, which means that reinsurers charge a premium for a portfolio of a primary insurance provider or large individual risks and, should a contract be concluded and a loss occur, then settle it. The reason that reinsurers exist is so that the total premiums received for all policies are higher than the claims to be settled. To do this, the reinsurer must be familiar with its customers’ business. This is best done with interdisciplinary teams that can look at risks from a wide variety of viewpoints. That’s why it’s not strange for a biologist to sit next to a mining engineer in the office.

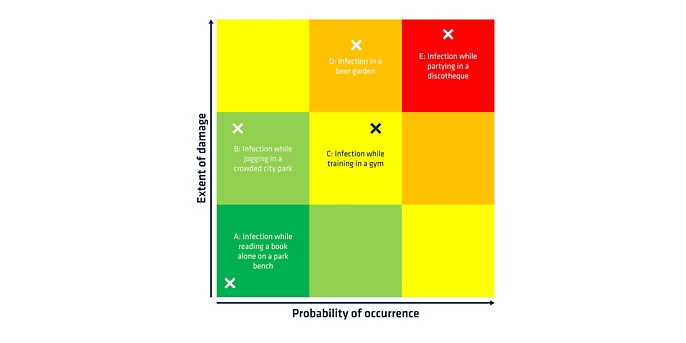

Risk = probability of occurrence x extent of damage

When a reinsurer is offered a new business for underwriting, it begins, to put it very simply, a huge brainstorming session in which it defines what economic consequences assuming the risk could possibly have for the reinsurance company – in other words, whether the probability of the risk occurring is within the range of the risk appetite. This is a similar situation to what we had in Germany at the beginning of 2020. A new type of virus emerged, the first wave of people ended up in intensive care units and we as a society had to ask ourselves in which areas is the risk of transmission high and what measures can we derive from this to prevent infections? Using a risk matrix can be a useful starting point in this situation, where the probability of occurrence is plotted against the extent of the damage. In the case of Covid-19, this means plotting the probability of infection for the individual against the increase in incidence rate. The diagram below illustrates a few examples that were the subject of great debate among the public during the first few months of the pandemic. A lack of data meant that the activities were not classified based on real figures, but purely on the author’s assessment.

The explanation for freely classifying the various risks according to the author’s assessment is as follows:

a: Reading a book alone on a park bench is fairly unlikely to result infection; the extent of damage is low in social terms since not many people tend to read alone on benches. This results in a low risk.

b: People have little contact with others when jogging so the probability of infection is low, but a lot of people go jogging, which is why the extent of the damage could be somewhat higher. The risk is thus rather low.

c: Gyms are enclosed spaces with narrow changing rooms, so the risk of infection is higher than when jogging. Similar numbers of people go to gyms as go jogging, correspondingly, the extent is about the same. This results in a medium risk.

d: Beer gardens are outdoors, meaning there is a medium probability of infection as a result. A lot of people go to beer gardens, so the extent of damage is high. This results in a high risk.

e: Clubs are closed rooms with little space per visitor, which means the probability of infection is high. A lot of people go to clubs, so the risk is very high.

Risk assessment

Once a reinsurer has identified the risks of its potential customer and removed some of them from the scope – such as the bookworm sitting alone on the park bench in the example above – it has to assess the remaining ones. The most important tool for this is statistics, that is, the calculation of expected loss values based on data from losses that have already occurred. This is also the reason why hardly anyone wanted to insure e-scooter riders a few years ago. Insurance providers found it difficult to adequately assess the risk due to a lack of claims data.

Reinsurers, however, are pioneers in collecting and interpreting data on a wide range of topics. And we adessi help them to do so with our broad range of services and products – whether it’s digitising dusty files, transferring old databases into the cloud, evaluating data with machine learning, automatic processing using machine learning or visualising data in a CRM.

Reinsurers often have a huge treasure trove of data with information on a wide range of topics. This is because a reinsurer must have a sufficient database to assess the customer’s risk with a high degree of certainty and thus be able to calculate a base rate. It uses the base rate to calculate the lowest possible premium, which it needs to underwrite the risk without making a loss itself. When it comes to Covid-19, there are several values that could be used as a base rate. Almost all of them have been tried at least once over the past two years. Depending on the control strategy at the time, the R value, the incidence rate in relation to the capacity limit of contact tracing, the capacity in intensive care units and, more recently, the hospitalisation incidence rate have all been used.

The real difficulty, however, is not calculating a base rate, but collecting data correctly and understanding it sufficiently to make reliable statements about possible and probable developments. That’s why it is important to find out where people get infected, how often and under what circumstances. You have to think about the data that you need to collect at a very early stage, as the more data you collect and the longer you collect it for, the better you can identify patterns later on.

If you don’t have any data, you can’t insure or – even worse – you have to station police officers, who had definitely imagined their job would be quite different, on snowy hills to send families home who wanted to treat their children to a day tobogganing in the fresh air.

Risk mitigation

Anyone who has not had much to do with reinsurance probably thinks that a reinsurer’s work stops when it has set a premium with which, according to its calculations, it will earn a hefty profit. Ultimately, however, a reinsurance company is a group with a lot of equity that offers to transfer risk from insurance providers and larger companies. In the era of ‘cheap’ money, however, they often have enough in reserve themselves. Reinsurers must therefore design their premiums in conjunction with services and make them so attractive that their customers take notice. This can only be economical if risks are reduced. You can find out more about this in the blog post ‘Reinsurance industry in transition – from risk carrier to service provider’ written by my colleague Steen Nel Schwerdtfeger (available in German).

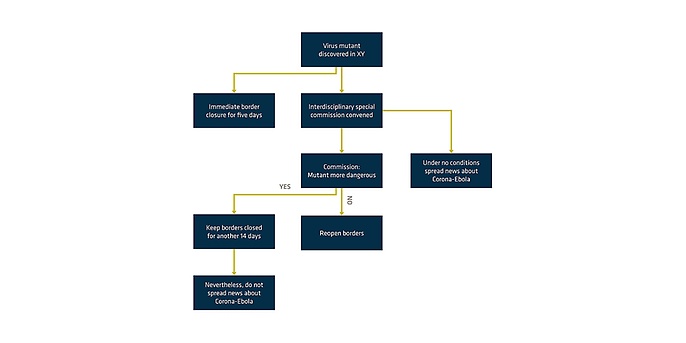

Reinsurers have centuries of experience with risks, so it is only logical that they have built up a considerable pool of techniques over time with which risks can be systematically mitigated. A prominent example, especially from large-scale industrial risks, is the conception of ‘trigger action response plans’, a tool used in disaster management. These are highly complex, easy-to-understand flow charts designed for accident-prone industries such as nuclear power plants or mining companies. These industries have been aware of the dangers of letting people make decisions under severe pressure for decades. This often takes a long time since nobody wants to take responsibility. And the person who then ends up making the decision often doesn’t have the best idea, but wants to make themselves stand out from the rest by making one – which can sometimes end in disaster. For this reason, technical measurement values (triggers) have been defined for such undertakings, which, when exceeded, result in certain predefined processes (actions) being carried out as a result (response). This takes the pressure surrounding decision-making out of emergency situations and ensures that everyone works together to solve the problem in the most efficient way without any wrangling over competencies.

Given the way everything has gone over the last two years, it’s probably obvious as to how these types of plans can be useful in the case of Covid-19. Levels can be defined, for example for full intensive care units, according to which action must be taken without prior discussions, and so on. The plan can be refined over time to target actual sources of infection. If the data shows that transmission is frequent in clubs, then at a certain level, for example, the first action is to introduce mask and test obligations, and if the numbers continue to rise, the clubs have to close, but other places remain open. Another example might be the discovery of a new viral mutation in a country (please note, this example is highly simplified):

Over time, reinsurers have built up considerable methods for identifying, assessing and reducing or even avoiding risks. Many of these methods could help us in our day-to-day lives in the pandemic as a supplement to the RKI’s recommendations to create greater transparency and thus strengthen understanding and acceptance of the various measures among the population, counteract the growing societal divide and, above all, to fight the disease in a more targeted way and thus regain more freedoms for everyone.

Would you like to learn more about exciting topics from the world of insurance at adesso? Then check out our latest blog posts.