26. April 2023 By Sabine Fischer

Pushing digital topics in the private health insurance sector

Private health insurance services in the spotlight

adesso has paid more attention to this topic and heavily invested in activities relating to the private health insurance sector over the past two years. These activities were bundled, and a consultancy team was founded. The employees on the team have a wealth of specialist expertise in the health insurance sector and are highly enthusiastic about IT. The Health Services team in the Line of Business Insurance is responsible for backend and frontend services relating to private health insurance. It works closely with other teams from statutory health insurance, app development (adesso mobile solutions) and standard software development (adesso insurance solution), as well as with many other adessi.

The team’s main focus is the optimisation and/or creation of technical processes and services for users. We look at the situation from the user’s perspective to develop user-centric services that offer added value for all stakeholders and may ultimately lead to a health ecosystem. Users may be policyholders or employees at private health insurance companies. I would like to give a brief overview of some of the things we have done thus far as well as provide an outlook below.

The digital medical device provision process

The electronic medical device provision process is a prime example of the combination of our specialist expertise, reinforced here by our cooperation partner HMM, and the technical expertise that can serve the frontend and backend.

HMM Deutschland GmbH is a provider of innovative care and billing solutions in the healthcare sector. More than 40 health insurance providers use the central platform operated by HMM, as well as the ‘LEOS’ online care provider suite, to electronically process the care provided to their policyholders by around 30,000 care providers, from application to approval, all the way to claims processing and settlement.

Together with HMM, we enable medical devices to be provided by providing digital control with seamless involvement on the part of the patients. In addition, private health insurance providers are ready to go with our German electronic prescription (elektronische Verordnung, eVO) service, meaning policyholders can use it as soon as it is introduced.

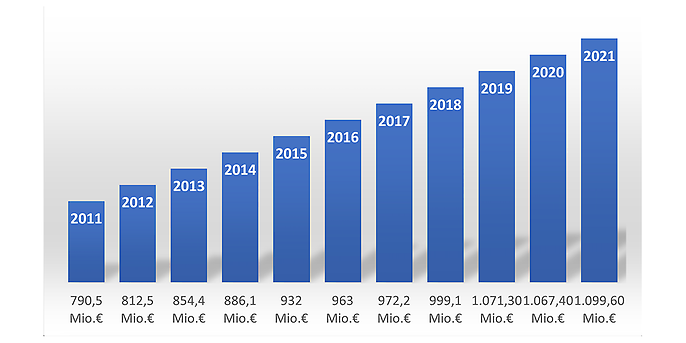

Based on the increasing need for medical devices (such as bandages, walking aids, wheelchairs or care beds) in Germany clearly demonstrated by statistics from the German Association of Private Health Insurance (Verband der Privaten Krankenversicherung, PKV-Verband [PKV]), we have entered into a cooperation with HMM Deutschland AG to enable a continuous digital process for all stakeholders.

Development of benefits for aids in private health insurance from the PKV figures report 2021

Our IT experts have designed an architecture together with the experts at HMM in which HMM’s services are connected, and interfaces build the bridge to the private health insurance provider’s systems. In addition, there are plans to develop a software development kit (SDK) for an app functionality that will provide transparency for the policyholder and make things more convenient. For a private health insurance provider, this means it will have an easy way to connect to its own systems as well as seamless integration into the policyholder app. This is already checked during development for our Ecosphere Health customers.

The connection to HMM gives private health insurance providers direct access to all medical supply stores and medical device providers in Germany, meaning policyholders do not have to contend with any restrictions. Regarding the increasing demand for medical devices in particular, private health insurance providers benefit from the automated processing of medical devices via the HMM specialist core, which takes the specifics of the sector into account.

The benefit calculation process

The medical device provision process is part of the benefit calculation process. There are manual processing steps in every area, just as there are in the calculation process for medical devices used currently. The potential for automation here is enormous – starting with the scanning software all the way through to the technical and policy-related check.

adesso offers this type scanning and checking software or is currently developing it. A process analysis with our team of experts can determine how best to integrate and configure the software to minimise manual steps. At the same time, we can investigate whether using fraud detection software is an option – always depending on the needs of the private health insurance provider.

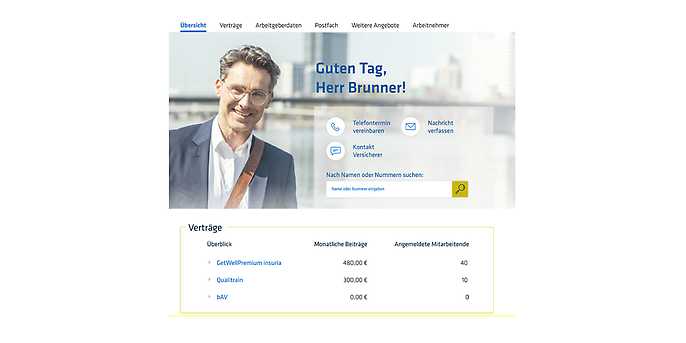

A platform for occupational health insurance

We have also used our professional and technical expertise in the area of occupational health insurance to develop a user-centred solution for employers and employees and to offer a process to reduce administrative costs for private health insurance providers.

This solution revolves around a platform that is connected to health insurance providers’ systems via interfaces to automate the processing of new policies and benefits. The platform can be accessed in two ways: through an online portal for the employer and an online app for the employee. The private health insurance provider can use both channels to place additional offers. The focus is on user-friendliness, smooth processes and an expanded range of products and services.

The advantage our solution for private health insurance provides lies in the fully automated creation of participants and the subsequent processing of benefits. There is no administrative effort, meaning the policy can be calculated at a correspondingly low price, thus making it competitive.

Activities that impact gematik

The digital transformation in the healthcare market can be seen in the activities of gematik, whose specifications in the area of statutory health insurance are being adapted by the German Association of Private Health Insurance for the private health insurance sector. This is often a lengthy process. However, it is safe to assume that the electronic patient record (elektronische Patientenakte, ePA), the German electronic certificate of disability (Arbeitsunfähigkeitsbescheinigung, eAU), the German e-prescription (eRezept) and the German electronic prescription (elektronische Verordnung, eVO) will also have to be available to policyholders with private health insurance in the future. This in turn creates in large number of action items and potential for prevention and rehabilitation.

adesso has entered into a preferred partnership with technology manufacturer RISE to support customers in the private health insurance sector in introducing and further developing the electronic patient record using innovative value-added functions, technologies and services based on the certified RISE technology. This sees the set-up, integration, operation and service for the electronic patient record provided from a single source.

While RISE develops, operates and enhances the electronic patient record, adesso offers all the integration and consultancy services regarding the app design. The starting point for this is the current private health insurance app, the future direction of the app and the legal frameworks to incorporate the electronic patient record app.

The ‘health’ ecosystem

The health sector has become significantly more important to people in recent years. This development offers health insurance providers the opportunity to position themselves as a preventive health service provider in order to both attract new policyholders and provide preventive support to existing customers before illnesses arise. But in any case, shifting perspectives to that of seeing the whole range of offered services from the customer’s perspective is critical to creating a ‘health’ ecosystem.

Another important feature of functioning ecosystems is the ability to access them on mobile devices. They are now used with far greater frequency than stationary devices, and this trend is plain to see. A mobile application must therefore be extended to the ecosystem accordingly. The services private health insurance providers offer in their apps these days are mostly limited to submitting receipts and viewing policies. Other services are largely only available via private health insurance providers’ online portals.

The experts at our subsidiary adesso mobile solutions enable us to provide support tailored to this trend and have a wide range of examples demonstrating the functionality and design of apps on offer. A survey of policyholders on the private health insurance app of the future has revealed the services that will need to be offered. They are not unreasonable requests by any means – they are a solid foundation that is already expected today, with some individual extras thrown in to improve well-being.

Conclusion

The challenges in the healthcare market are enormous. The task of a private insurance provider is now to define the position it wants to occupy and to identify and prioritise the topics that are key to achieving that.

adesso has positioned itself accordingly and will support private health insurance providers in this process. The ‘health’ ecosystem is growing together. Policyholders are increasingly concerned with their health and the support services available. It is time for private health insurance providers to promote and ideally steer this in their favour. Our experts are available to help this happen. Feel free to get in touch with us.

Why not check out some of our other interesting blog posts?

You will find more exciting topics from the adesso world in our latest blog posts.