17. August 2022 By Dr. Christina Mpakali and Alexander Eppenberger

Blog series Blockchain: How the new technology is finding its way into the Swiss banking world (Part 3)

In the first two parts of this blog series, we showed the development of blockchain fintechs since the emergence of bitcoin. We have seen how much this sector has developed and established itself. In addition, Switzerland has been able to position itself as a leading crypto nation thanks to the regulatory course set by FINMA at an early stage. What are the Swiss banks doing in the blockchain sector? We explore this question in this final part of the blog series.

Increasingly, banks are allowing customers to purchase and manage digital assets. This is slowly opening up the crypto world to the mass market: the hype is now becoming mainstream. Let us take a look at some crypto examples from the Swiss banking scene from the last three years:

UBS

The universal bank UBS ventured a first blockchain attempt by opening up the We.trade platform to its customers in order to process international trading transactions efficiently and without paperwork. This platform was co-financed by IBM and a dozen European banks.

Furthermore, UBS successfully completed a proof-of-concept that enabled the complete distribution of investment funds on the blockchain. For this, it used the FundsDLT platform.

Credit Suisse

Credit Suisse is also planning to bring fund distribution onto the blockchain with FundsDLT. In a collaboration with the blockchain startup Taurus, Credit Suisse tokenised the shares of an alpine resort. By digitising the shares, capital management was simplified in view of an upcoming secondary trade (purchase/sale of the share).

Credit Suisse is now looking to build on this experience and expand its product and service offering by analysing the potential for digital assets across all business lines.

ZKB

ZKB was also able to successfully exercise the trading of fund units on the blockchain with FundsDLT.

Raiffeisen

The bank Raiffeisen started the experiment of a crypto wallet to offer its customers a savings account for cryptocurrencies. Despite the successful prospects, the bank ended this experiment. However, there is an app that can be used to send or receive cryptocurrencies; however, it does not allow direct purchases.

Hypothekarbank Lenzburg (Hypi Lenzburg)

With the launch of the open banking platform Finstar, it is possible to tokenise and securely store digital assets. Hypothekarbank Lenzburg will expand its offering in this area in a forward-looking way.

Berner Kantonalbank

The Berner Kantonalbank (BEKB) is aiming for a solution that maps the entire process chain from issuing to trading to custody of tokenised assets on the blockchain. It wants to achieve this in cooperation with Hypi Lenzburg, the open banking platform Finstar (custody of digital assets) and Daura (legaltech company for the creation of a digital share ledger). This digital marketplace was in factintroduced by BEKB at the end of 2021.

Julius Baer

The private bank Julius Baer has partnered with SEBA Bank to use its platform. This enables Julius Baer to offer its clients a wide range of digital asset services. The bank is aware of the potential that is hidden in the DeFi area which is reflected in its Strategy 2022-2025. It plans to further develop digital assets in the context of wealth management in the coming years.

Bank Vontobel

Bank Vontobel launched the Digital Asset Vault in 2019 - a custody solution for digital assets that meets the required standards of the regulatory authorities. The tool enables the offering of multiple crypto-related services such as the purchase, transfer, and safekeeping of digital assets. The bank distributes this tool to other banks and asset managers. In the same year, the bank also launched structured products on the blockchain.

BKB/CLER

In 2021, the introduction of a crypto trading and custody service for BKB/CLER clients was planned. However, the project was halted in order to focus on other strategic areas.

Swissquote

The online bank Swissquote already offers trading in cryptocurrencies and structured products and is constantly expanding its offering. It is very keen to position itself strategically in this area, where it intends to open its own crypto trading platform before the end of the year. It aims to offer its infrastructure to other banks that will follow later in this business field. Building such an infrastructure is costly, so this use case could work out for Swissquote.

PostFinance

In collaboration with Swisquote, PostFinance launched an app - Yuh - that allows its customers to trade a selection of cryptocurrencies. As if that were not enough, PostFinance launched its own digital coin, the Swissquoin (SWQ). What is special about this coin is that it can only increase in value. This is made possible by reinvesting a monthly amount per Yuh customer in SWQ. Thus, the value increases with the rising number of Yuh users. PostFinance will certainly continue to expand its offer in the area of digital assets.

Sygnum

Sygnum was one of the first digital asset banks in the world with a Swiss banking licence. This enables institutional and private investors to invest in the digital asset economy.

SEBA Bank

The second licensed Swiss crypto bank bridges the gap between digital and traditional assets. Customers can invest, hold, trade and lend traditional and digital assets in one place and issue tokens.

SIX/SDX

At the end of 2021, the Swiss stock exchange SIX launched its own platform for trading tokenised as-sets: SDX, SIX Digital Exchange.

In the mid-1990s, when SIX came into being, it enabled investment products to be traded electronically. Clearing, settlement and custody followed outside SIX. The new SDX platform accomplishes all these steps simultaneously. The Swiss stock exchange is the first in the world to create a holistic platform for tokenised assets – even in a regulated environment.

These examples show that well-known banks have started initial trials with blockchain technology and are researching interesting use cases. Many have already recognised the potential of this technology and are offering their customers initial products and services. Others have firmly anchored development in this direction in their short-term strategy. However, there are also banks that are avoiding innovations in this area for the time being and would rather follow what is happening on the market in order to join as smart followers at some point.

How will banks develop in the area of blockchain in the coming years?

Current trends have shown that the first banks are venturing into the business field of digital assets. Be it by offering trading in cryptocurrencies, tokenisation of assets or trading and custody of digital assets. As we have seen from the examples above, most banks are using third-party providers with the corresponding infrastructure.

Some of these banks will go on to build their own technological platform and develop their own range of digital assets or services for crypto products for their customers. It is also possible to capitalise their own platform, services or products. Bank Vontobel is already doing this with Digital Asset Vault, as are the two crypto banks Sygnum and SEBA. We have also seen efforts in this direction from Swissquote.

Eventually, the business with crypto products or the shifts of the traditional banking business into block-chain technology will have unfolded to such an extent that a thriving ecosystem between banks, technology companies and customers will have emerged. Then DeFi will not only be a theoretical idea of future banking but a reality. A reality that brings with it the benefits of cost efficiency, security and transparency thanks to blockchain technology.

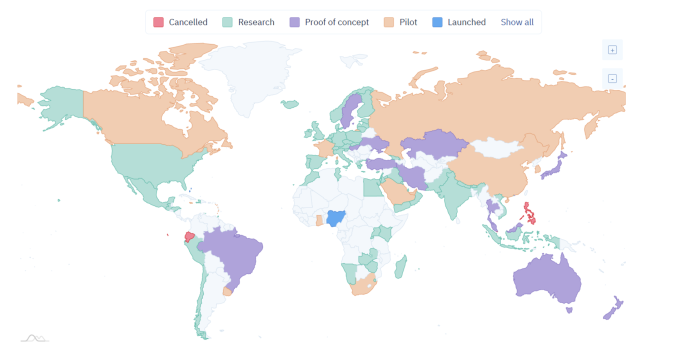

Another trend that is already emerging and will become more concrete in the coming years is the issuance of digital central bank currencies. The chart shows which central banks around the world are in which phase of researching and developing a digital central bank currency.

Today's Central Bank Digital Currencies Status

Source: CBDC Tracker (www.cbdctracker.org)

Central bank currencies worldwide

The first digital central bank currency was launched in Africa in November 2021: Nigeria banned the trading of cryptocurrencies due to their popularity and the resulting devaluation of the national currency, the Naira. Instead, the Nigerian central bank introduced the state digital currency, eNaira. The eNaira is supposed to exist parallel to the Naira and make financial transactions easier and more seamless for all strata of society. The Bahamas has also introduced a central bank currency, the Sand Dollar.

The Swiss National Bank has been looking into the e-franc for two years. In 2020, two feasibility studies for the issue of a digital central bank currency and the settlement of tokenised assets with this digital central bank currency were successfully completed. Nevertheless, the e-swiss franc will not be introduced for consumers. Primarily the digital franc was planned for credit transactions between commercial banks in Switzerland and abroad (increasing efficiency). Until now, a concrete introduction of the e-swiss franc by the Swiss National Bank has not been planned.

The European Central Bank is taking a more concrete approach: the digital euro is to be introduced by 2026. With it, the average consumer will be able to make ordinary payments just like with the euro. It is conceivable that the digital euro could be stored in a wallet and that payment in a shop could be debited directly in real time via the digital euro using an app.

Why are we seeing this global effort towards digital central bank currencies when there is already a wide range of cryptocurrencies? Perhaps precisely because central banks - as well as traditional ones - may feel threatened by disruptive new players such as cryptocurrencies and stablecoins. A digital central bank currency could help them to avoid being left behind and instead to continue to play a role in the financial ecosystem.

This is where blockchain comes into play

In our three-part blog series on the 15th anniversary of Bitcoin and blockchain technology, we showed that this technology goes far beyond the Bitcoin payment system and the trading of cryptocurrencies. With the technology, it is possible to map the entire financial world in a decentralised way in the digital world. And other business areas are also opening up completely new opportunities through the use of smart contracts or NFTs on the blockchain. This new technology is in the starting blocks for a disruptive change. As soon as the first business models on the blockchain show success in the mass market, entire industries will follow - just as e-commerce caused a fundamental change in the consumer goods industry 20 years ago.

Several blockchain companies are already ready for this change with their products and services world-wide. We saw in the second blog post that Switzerland, in particular, has positioned itself as a leading crypto nation thanks to the innovation-promoting regulator. A legal framework is important for emerging technologies in order to create trust on both sides: for the customer as well as for the company. This favours the acceptance of innovative technologies.

Outlook for the financial world

The technology has not yet been fully accepted in the financial world. We have shown examples of various Swiss banks which are merely experimenting with blockchain technology for the first time and analysing possible use cases for themselves. Central banks around the world are also exploring the idea of digital central bank currencies. Only very few banks in Switzerland currently offer their clients initial products or services in the area of digital assets. These are mostly first mover banks that have already recognised the potential of the blockchain and want to gain an early advantage. We will see in the near future how the financial offering on the blockchain will unfold and extend out into the Swiss banking field.

Blockchain technology is here to stay - that much is certain. Although we can already see the first concrete use cases and business areas, the technology is still evolving enormously. There are still weaknesses such as energy consumption and scalability which need to be overcome before blockchain will establish itself in the mass market.